Long-Term Wealth Opportunity

We perform deep diligence to find the right management teams and product strategies to produce the best investment results. We provide access to qualified investors willing to take advantage of our efforts and join us in the pursuit of wealth creation.

Investing in leading potential opportunities for the long term.

Circular

Strategy

Three services working together to

improve

investment

valuation

analysis,

qualify businesses

in private markets and enable

informed

public market

analysis. Strengthened as a whole by the Performance across all.

We

love

to

Learn

And that’s a key element to what drives us and makes us successful. Learn as much as possible. Apply that knowledge to drive investment decisions that adhere to the Swingbridge investment philosophy.

Our Process

Driven by the Constant Pursuit of Inquisition

Dedicated to Diligence

Constant research is necessary to finalize an investment thesis. Opportunities are vast. The great ones require dedication and time to be vetted.

Achieve True Clarity of Potential

Critical firm resources are exclusively focused on the investing process, pattern recognition processes cull the field of opportunity, and a deep diligence process establishes clear knowledge in the areas of potential investment.

Measure Success Together

Investment decisions are made as a team and results are measured collectively over a long period of time versus traditional benchmarks.

Together

We Learn and Win

as a Team

What

we

learn we share

to educate our investors so they become even

better investors

themselves. We

compete

as a

team. We

compete

to

win.

To win we need to be the

best at applying knowledge to investing.

We are unified in our passion to

learn

and that’s a

critical part

of our

competitive advantage.

We

love

to

Learn

And that’s a key element to what drives us and makes us successful. Learn as much as possible. Apply that knowledge to drive investment decisions that adhere to the Swingbridge investment philosophy.

Our Process

Driven by the Constant Pursuit of Inquisition

Dedicated to Diligence

Constant research is necessary to finalize an investment thesis. Opportunities are vast. The great ones require dedication and time to be vetted.

Achieve True Clarity

of Potential

Critical firm resources are exclusively focused on the investing process, pattern recognition processes cull the field of opportunity, and a deep diligence process establishes clear knowledge in the areas of potential investment.

Measure Success Together

Investment decisions are made as a team and results are measured collectively over a long period of time versus traditional benchmarks.

Together

We Learn and Win

as a Team

What

we

learn we share

to educate our investors so they become even

better investors

themselves. We

compete

as a

team. We

compete

to

win.

To win we need to be the

best at applying knowledge to investing.

We are unified in our passion to

learn

and that’s a

critical part

of our

competitive advantage.

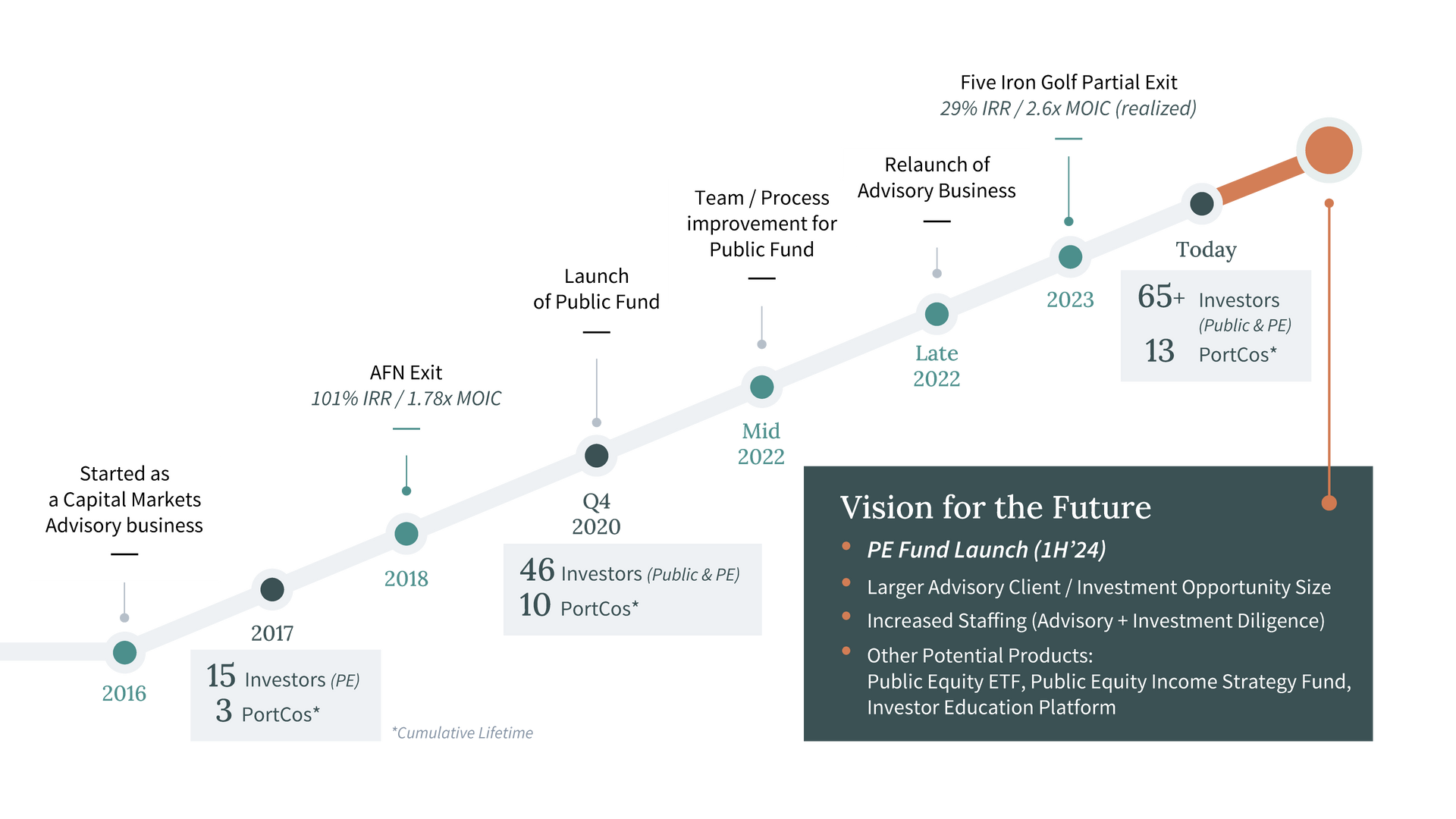

2016

Tom Kerestes and Rob Levy Founded Swingbridge

2020

Launched "Swingbridge Public Equity LP" as a Traditional Fund Vehicle for Investing in Public Equity Markets.

14

Private Companies Backed to Date

65+

Accredited Investors or Families Invested Alongside Swingbridge

Our HISTORY

Swingbridge Timeline

Frequently Asked Questions

Looking to Invest With Swingbridge

-

How do I become one of your Investors?

The first step is you need to be an Accredited Investor according to the SEC’s definition of it. If that is the case, reach out to us here and we can discuss. Typically, we like to get to know our Investors a bit first, and then we can start sharing Investment Opportunities for their review.

-

What size are the investments you make into Private Companies?

This varies. We tend to target the $1M-$4M range, though some of that may come via follow-on investment opportunities after our initial investment. Ultimately, the ultimate sizing of our investment depends on our assessment of the risk / return profile.

-

What is the minimum investment amount you’d accept from a new Investor?

This varies on a situation-by-situation basis. Generally speaking, our stated investment minimum for our Private Equity investments is $25,000, and our stated minimum for our Public Equity LP is $150,000. However, as we are looking to provide access to those who want it, we don’t want to let an investment minimum necessarily stand in the way of that, so we reserve some flexibility in those discussions.

-

How has your performance been to date?

We're happy to discuss this in detail with potential new investors once we have begun initial introductory conversations to ensure the right fit.

-

Who are your investors?

Any Accredited Investor is a candidate to invest with us. Often, our investors are professionals who want more equity exposure, but don’t have the time, or experience, to source and assess investment opportunities on their own. Other times, our investors are people or families simply looking to diversify their current investment.

Looking to Have Swingbridge Invest in My Company

-

What types of Private Companies do we invest in?

We truly are opportunistic in this regard, as we invest in all types of businesses. We have invested in pre/early Revenue businesses, we have invested in pre-IPO businesses, and we have invested in long-standing cash-flowing businesses. On the industry side, while our total portfolio has a higher weighting within the FinTech/Financial Services sector, we have invested across numerous industries and remain agnostic going forward.

-

When you invest in a Private Business, are you taking full control / doing a full buy-out of the business, or taking minority ownership positions?

This can vary. To date, we have exclusively taken minority ownership positions, as we generally prefer to back founders or management teams who can run the business successfully on their own. However, given the opportunistic nature of our approach, we will consider control Private Equity investments if we believe we have the expertise and network to help drive substantial value creation.

-

Would you consider investing in my Private Company?

Of course - please send us a message using this link, and we’ll try to get back to you with our initial thoughts.

-

What key features do you look for when considering an investment in a Private Company?

From a high-level, our initial screen is on the Management Team, the Product, and the Valuation.

- For a Management Team, we’re looking for individuals who are aligned with their equity investors and fully committed to the success of their Company, have a passion for their industry with a competitive drive to win, and most importantly, showcase the ability to lead in a trustworthy manner.

- For Product, we’re looking for a product that offers a scalable solution to a problem within a large market, or the ability to be THE market leader within its market. As a plus, a Product that we can relate to in one way or another on a personal basis helps us truly understand the value prop.

- For Valuation, this isn’t just the price of the investment on its own. We cross-check that versus the business’s fundamentals and financial performance (past and projected), the defensibility of that financial performance, and the business’s overall capital efficiency.

Importantly, while we think about the potential for an exit or eventual monetization of our investment, our long-term focus makes this a secondary thought rather than a driver of our evaluation.

-

What size are the investments you make into Private Companies?

This varies. We tend to target the $1M-$4M range, though some of that may come via follow-on investment opportunities after our initial investment. Ultimately, the ultimate sizing of our investment depends on our assessment of the risk / return profile.

Looking to Swingbridge for Financial Expertise and CFO Advisory Services

-

What types of companies does Swingbridge advise?

We advise businesses in a variety of industries and of varying sizes. These companies generally recognize the need to invest in themselves further and to focus on initiatives that drive differentiated returns for business owners and investors. Many times, they need the additional financial expertise Swingbridge brings to accelerate financial progress, fortify their business strategy, and predict performance with precise data and years of experience.

-

Does my company need to be part of the Swingbridge investment portfolio?

No. We are happy to advise companies that may or may not need a near-term capital raise or investment. We do, however, use our perspectives as investors and capital markets experts to guide our approach to financial consulting and CFO services.

-

What financial advisory services does Swingbridge provide?

Our financial advisory offerings are tailored to your needs. The list below is not all-encompassing but may include one or more of the following:

- CFO support for projects, transaction readiness, capital raise, and deployment.

- Monthly fractional CFO services that build your team’s financial capability at a lower investment.

- Business modeling, budgeting, and forecasting.

- Financial process design, improvement, and control implementation.

- Accounting and reporting.

- Cash management and treasury.

- Capital expenditures and ROIC.

- Revenue cycle.

- Procurement / disbursement cycle.

- Management reporting, dashboards, and KPIs.

- M&A support and exit transaction diligence.

-

What is the Swingbridge Advantage?

We bring additional value to your enterprise by providing services as investors would prioritize them. The Swingbridge Advantage is derived from100+ of years of combined experience in strategic CFO and Capital Markets leadership. This includes private and public company experience, an extensive investor / lender network, and bench marking / research capabilities.

ABOUT SWINGBRIDGE

Financial Advisory Services:

A Bridge to the Next Level

A Bridge to the

Next Level

We help focus

financial processes

and

support enterprise strategies

by offering CFO Consulting Services to

CEOs, CFOs

and

Business Owners

ready to:

Optimize Financial

Operations

& Improve ROI

Predict & Drive

Performance

with Precise Data

Accelerate

Financial Progress

Invest in

Their Companies

Fortify Key

Business Strategy

with Financial Expertise

We assist in building out the strategy and process refinement necessary to be

go-to-market ready.

CFO Support

& Collaboration

We are

Part of the Team, providing financial expertise and supplemental leadership to help build a highly effective financial function. This frees up entrepreneurs and CEOs to focus on

strategy, growth, and operations.

Ultimate

Results:

Higher Growth & Profit Realization

Better Informed CEO & Leadership Team

High-Value Strategic Support for Your CFO or Finance Function

Higher Company Value on Exit or Next Transaction

Higher Returns Vs. Lower Cost of Capital

Long-Term Minority Capital Investments

CFO Consulting

Services

We offer

strategic CFO leadership

to help focus your financial processes and support your enterprise strategies.

- High-Value Strategic Support for Your CFO or Finance Function

- Better Informed CEO & Leadership Team

- Higher Growth & Profit Realization

- Long-Term Minority Capital Investments

- Higher Returns Vs. Lower Cost of Capital

- Higher Company Value on Exit or Next Transaction

WHO WE WORK WITH

Businesses, CFOs, CEOs

Your organization can leverage the expertise Swingbridge offers to prepare referred companies for strategic growth, benefiting both the referral partner and the referred company.

Partners

Your organization can leverage the expertise Swingbridge offers to prepare referred companies for strategic growth, benefiting both the referral partner and the referred company.

Learn more about advisory services here:

Independent Sponsors

Your organization can leverage the expertise Swingbridge offers to prepare referred companies for strategic growth, benefiting both the referral partner and the referred company.

CFO Consulting Services

We offer strategic CFO leadership to help focus your financial processes and support your enterprise strategies.

CFO Consulting Services

We offer strategic CFO leadership to help focus your financial processes and support your enterprise strategies.

CFO

Support &

Collaboration

We are

Part of the Team, providing financial expertise and supplemental leadership to help build a highly effective financial function. This frees up entrepreneurs and CEOs to focus on

strategy, growth, and operations.

FINANCIAL ADVISORY SERVICES

Focus + Strategy Calibrated by Expertise

We apply our financial expertise (that’s perpetually growing) to help businesses enhance the value and effectiveness of their financial function.

Swingbridge offers a robust suite of CFO services that elevates the Financial Operations, Capital Markets Strategy, and Return on Investment for CEOs, CFOs and Business Owners ready to invest in the Next Level of their company.

CFO

Support &

Collaboration

We are

Part of the Team, providing financial expertise and supplemental leadership to help build a highly effective financial function. This frees up entrepreneurs and CEOs to focus on

strategy, growth, and operations.

1

High-Value Strategic Support for Your CFO or Finance Function

2

Demonstrated History of Effective ROIC Profiles

3

All-in Management Teams

4

Differentiated Product Strategy with Defensibility

5

Clear Operating Strategy with Predictable Financial Models

6

Attractive Return Skew

(Upside Potential vs. Downside Risk)

The Hallmarks of a Swingbridge Investment

Portfolio

Swingbridge Private Company Investments

As industry and stage agnostic investors, we have no strict guidelines on the types of private equity opportunities we'll consider. Our unique structure, including

an 'Advisory First' approach to getting to know businesses, allows us to be very flexible with a variety of opportunities, which in turn, creates unique access to our investors.

meet Swingbridge

- We see value in our audience, so they see the value in us.

- We are Passionate about Learning and do it Constantly.

- Diligencing Business Leaders for Long-Term Opportunity

Tom

Kerestes

Tom

Kerestes

- We see value in our audience, so they see the value in us.

- We are Passionate about Learning and do it Constantly.

- Diligencing Business Leaders for Long-Term Opportunity

- Cofounder/CEO of Swingbridge

- Over a decade working in Capital Markets on Wall Street

- Detail oriented with a desire to listen and learn everyday

- Avid sports fan (especially Notre Dame football) who tries to coach his kids' sports teams whenever possible

- Semi-competitive BBQ cooking enthusiast

Tom

Kerestes

Rob

Levy

- Cofounder/CIO of Swingbridge

- 20 years of equity investment training and counting

- Personal Detail 1 - Exploration and Learning

- Personal Detail 2 - Travel

Get in Touch

Whether you are an accredited investor looking to learn more about working together or a business owner looking for advisory services, we welcome the inquiry.

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Contact Us

If you're looking for more information on Swingbridge regarding how we can possibly work together or otherwise, please don't hesitate to ask.

Are you an accredited investor looking to learn more about investing with us?

Or are you a company looking to get funding?

Just select your request in the form and we'll reach out as soon as we can.

Mailing Address:

330 Franklin Road, Ste 135A-269

Brentwood, TN 37027

Office Location:

10 Burton Hills Blvd Suite 400

Nashville, TN 37215

info@swingbridgellc.com

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.