Understanding Cap Stacks

A Look at the Many Different Forms of Investor Capital

As an Investment Company, like any other, we are constantly evaluating opportunities to provide Companies with capital to allow them to operate their business. In exchange for that capital, we receive something in return - most often equity ownership in the Company - that will allow us to share in the Company’s future cash flows and/or realized value growth, and thus, see our capital grow over time. This is the basics of investing.

Of course, “investing” is a far more complicated concept than described in the above paragraph. And among other things, the “something” that Investors receive in exchange for providing capital to Companies comes in a variety of forms, based upon the Investors’ specific interests. From the lens of the Company, this variety of forms is what makes up their

capital stack.

What is a Capital Stack?

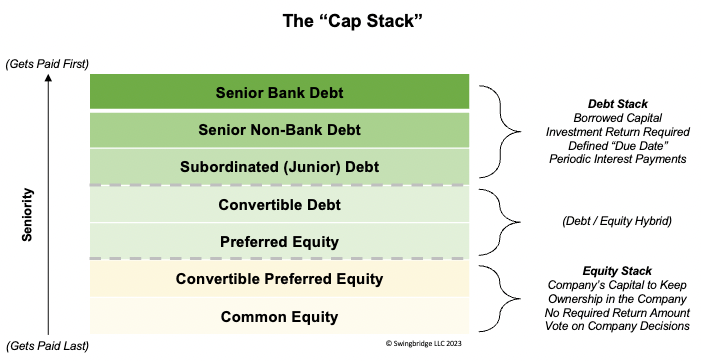

In short, all the capital that a Company has accepted over time to help them finance the operations of their business is represented through the Company’s capital stack, also known as the "cap stack". The cap stack itself shows the various types of capital they have accepted, and it shows the order of seniority of each type with regards to the capital providers getting their capital (hopefully plus a return!) back at some point in the future.

Within the world of Private Equity, debt and equity are the two main categories of Investor capital within a business’s cap stack. But there are different types of each, which allows for both flexibility and complexity when a Company builds out their cap stack over time.

Here is a look at the possible layers of a cap stack (note: generally speaking, Companies might have some of these but never all of these):

See a detailed explanation of each layer of the cap stack at the end of this post.

The gist of how a cap stack works is that the more senior a capital provider is on the cap stack, the more certain their future investment returns will be, and the more control they will have over how the Company uses their capital. As a result, the less expensive that capital will be to the owners of the Company.

As a Company works its way down the cap stack from debt to debt/equity hybrids, to equity, the cost of that capital gets more expensive. This is a requirement of the capital providers as they agree to give up some of that seniority and control.

And from those capital providers’ perspective, the range of possible investment outcomes widens as they move down the cap stack. Senior Debt providers know that (assuming proper underwriting) their downside is limited because the odds of them losing all of their money are very low while their upside is capped because they are charging a set interest rate. Conversely, equity holders know that they carry more risk given if the business goes bankrupt, they are unlikely to receive any return of their investment after the Company repays outstanding liabilities (including debt), but they also have unlimited upside if the business value is to grow substantially.

For each Company, it is an important decision to think about the type of capital they want to take to operate their business. Of course, not all companies have the fortune to just pick and choose from any of the types listed in the cap stack diagram above, but to the extent they are choosing between two options, they need to consider the costs and benefits.

Today’s Funding Environment

As we’ve found ourselves in a recessionary period, or at least concerns about a potential economic downturn have increased, banks have chosen to be more conservative about who they lend their capital to lately. Layer in the Silicon Valley Bank collapse back in March 2023, and we’ve reached a point where it’s very difficult for Companies to successfully source Bank Debt today. We see this in our everyday interactions with our portfolio companies and clients as they seek out Bank Debt.

Because Bank Debt has become harder for companies to access lately, we are currently in an environment where Non-Bank Debt is becoming even more popular. There are a lot of companies that want debt financing, and they are turning to the private credit lenders who are eager to lend their capital. Anecdotally, we have had numerous discussions with our bank friends who have indicated expectations for this to be the case going forward in the near-term. This situation combined with the costlier nature of Non-Bank Debt could pose an issue at some point in the future if we do head into an economic slowdown, but we’ll reserve macroeconomic predictions for another time.

In the end, not all capital providers are created equally, and each Company’s specific situation may make one option better than another.

At Swingbridge, we work with many Companies to think through this decision and find the best approach.

By leveraging our years of experience in the Capital Markets, we are able to help Companies get to the financing solution that best fits their business, positioning them for the best long-term success.

*** For those who want to read more detail about each item on the cap stack***

1. Senior Bank Debt

Banks tend to be very conservative. They don’t typically lend out their money unless they are very confident they’ll get it back. As a result, their threshold for which types of businesses qualify to borrow their capital is quite high, and more importantly, they make sure that they get their money back before any other capital providers. Bank Debt is always the most senior position on the cap stack.

In addition to the seniority, Bank Debt is typically structured with strict, shorter-term maturity dates, variable interest rates that increase in rising rate environments (aka protect the bank by getting more expensive for borrowers), and numerous covenants, which are rules the business must follow to continue borrowing the bank’s money. On top of this, Banks will have a right, called the “first lien”, on the assets of the Company, which means if necessary, they have the legal ability to take ownership of the Company’s assets and sell them to recoup their capital.

Of course, in exchange for all these terms that protect the bank, Bank Debt is generally considered the “cheapest” source of capital for a Company, because it will traditionally carry the lowest required return via low interest rates. If a Company is able to check the required boxes to qualify for Bank Debt, it is often (though certainly not always) a great option to include on their cap stack.

2. Senior Non-Bank Debt

If a Company has Bank Debt, there is no other “Senior Non-Bank Debt”, as there can only ever be one “Senior Debt” position on a cap stack, and that would be the Bank Debt. But, for the many businesses that don’t have Bank Debt, once they bring on any debt to the cap stack, it’s technically “Senior Non-Bank Debt”. If it’s the only debt on the cap stack, it doesn’t really need to be referred to as “Senior”, but when there is other debt that is subordinated to it (more to follow), then it qualifies as such.

Non-Bank Debt is debt that comes from private credit lenders. This could be individuals or Family Offices providing a loan to a business, or any of the many institutional funds that focus on this investment class. And because it can come from so many different types of capital providers, it can come in many different forms. That being said, like Bank Debt, it typically carries a set date when the capital must be repaid, requires periodic interest payments, and it’s not uncommon for it to come with some covenants and liens, as well. However, unlike Bank Debt, it is more common to see fixed interest rates, as opposed to the variable interest rates traditional to Bank Debt. Typically, the constraints put on a business by Non-Bank Debt are less than those required by Bank Debt, so the interest rate tends to be higher (more expensive) than the rates associated with Bank Debt.

3. Subordinated (Junior) Debt

The last of the “traditional” debt on the cap stack, Subordinated Debt is no different than Senior Non-Bank Debt, other than when they both exist on a Company’s cap stack, the Subordinated Debt is lower in seniority to the other debt. This is why it’s sometimes referred to as “Junior Debt”. While the general features are the same, the cost of Subordinated Debt will usually be more expensive - via higher interest rates - than that of the Senior Non-Bank Debt.

It is not uncommon to see some portion, if not all, of the Subordinated Debt interest rate to be “accrued”, rather than paid as cash. In this case, the interest owed each period is added to the total amount of investment that must be repaid at maturity, rather than being paid out at the end of each period. This helps businesses preserve cash in the short-term that they otherwise need for operating their business.

While the general terms, outside of interest rate, may be very similar for Subordinated and Senior Non-Bank Debt, because the Senior Debt will usually put more restrictions on the business, it is less common to see many restrictions, or covenants, associated with Subordinated Debt. This makes this kind of debt an attractive option to many businesses since it allows them to run their business more freely - but the higher interest rate must be considered.

4. Convertible Debt

This is a very common type of debt that might be seen on the cap stack for a Venture Capital funded Company. The purpose of Convertible Debt is to help a business get to a point of operational performance that will allow them to be more marketable to other Investors, to (typically) raise equity capital at that time.

There are two main unique aspects of Convertible Debt relative to other debt. First, the interest is almost always accrued, rather than paid in cash each period. Second, in most cases, the original investment and accrued interest eventually gets converted into equity of the Company, rather than getting repaid. Because of this, while it is debt on day one, it is traditionally thought of more as an equity security. Thus, the graphic above refers to it as being a hybrid of debt and equity.

The “conversion to equity” feature of Convertible Debt is the most important term, as it dictates the price of that equity at some unknown point in the future. It usually is driven by a discount to wherever the next equity investment valuation prices and a cap on how high the equity valuation used for the conversion can be. This is designed to allow the Company to reward the Convertible Debt Investor for providing the necessary capital by giving them a lower equity price than what the next equity Investors pay.

Also, note that this post ignores SAFE notes, which are very similar to Convertible Debt but importantly not debt on a Company’s cap stack. SAFEs, which stands for “simple agreement for future equity”, function enough like Convertible Debt to be included in this section.

5. Preferred Equity

This is the other “hybrid” debt and equity structure listed on the cap stack graphic. While Preferred Equity truly is considered equity, and not debt, on a Company’s Balance Sheet, in the world of Private Equity, it typically acts more like debt in that there is an associated required dividend payment that looks like an interest payment. And on top of that, typically there is some period of time after which the Company is responsible for paying back the Preferred Equity capital provider’s initial investment. Because of this, many capital providers view Preferred Equity and Subordinated Debt through a very similar lens.

One important distinction between Preferred Equity and the other forms of equity to follow is that it doesn’t tie to ownership in the Company - despite being “equity”. Instead, it is simply a layer of equity that must get repaid to the capital provider prior to any other equity providers receiving payments. Because of this, some Preferred Equity capital providers will require additional Common Equity (or warrants / options to buy Common Equity for a negligible cost) to increase their capital return potential should the business value increase following their Preferred Equity investment.

6. Convertible Preferred Equity

This is the most common security that will be seen on a Venture Capital funded Company cap stack. Each time a Company raises equity capital, they will usually issue a different class of Convertible Preferred Equity, referenced by a letter (i.e. Series A, Series B, etc.). Naturally, these designations have turned into identifiers for various stages of business within the Venture Capital investment world, and certain VC funds limit their investment focus to specific stages.

While this security on its own acts a lot like the Common Equity of the Company, it is placed in a different class on the cap stack to ensure its “Preferred” feature in the event of any distributions being made. The combination of the “Convertible” and “Preferred” features of this security give the capital providers the same upside as Common Equity owners should the value of the Company increase - in which case they would convert their Preferred Equity to Common Equity - while preserving some seniority to Common Equity in the event of any lower-than-expected distribution amounts. Like most of the cap stack classes more senior than it, it typically comes with some protections over what the Company can or can’t do without approval of the Convertible Preferred Equity owners, albeit less than that of traditional debt covenants.

7. Common Equity

The last piece of every Company cap stack, and as a result least senior, is the Common Equity. This represents the true equity owners of the Company. It is considered “common” because it typically includes owners who are employees of the Company who have earned their equity rather than “purchased” it by providing capital. In this sense, the capital providers and workers who own Common Equity are all aligned on the success of the business given they share equal rights to future cash flows or distributions. Common Equity owners carry the most risk since every capital provider on the cap stack has to be repaid before they receive a dollar. But as a result, when things go well for the Company and its valuation increases dramatically, it is the Common Equity owners who have the most upside on their investment return.

Join Our Blog Email List

Sign up to receive our latest blog posts directly to your email as they are published.

Thank you for subscribing to our blog email.

Oops, there was an error submitting your email.

Please try again later.

Let's Talk

Did this article spark a question?

Want to learn more about Swingbridge or how to work together?

Feel free to reach out.

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Subscribe to the Blog